Fringe benefits are benefits you give to employees in addition to their regular wages. Taxable fringe benefits are.

What You Should Know About Gift Giving In The German Workplace The

What You Should Know About Gift Giving In The German Workplace The

I did some research on the question of are gift cards taxable income to employees a few years ago and what i found was not great.

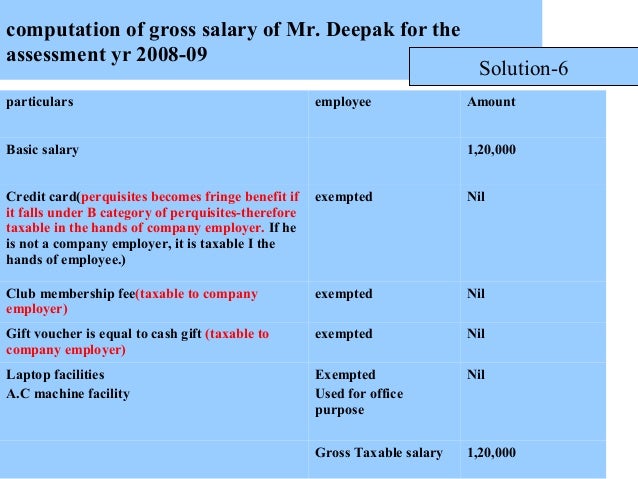

Are gift cards taxable income to employees. Fringe benefits generally count as taxable income except when they are specifically excluded from taxation which is the case with health benefits or when they are what the irs calls de minimis fringe benefits. Internal revenue code section 102 covers the general rule that excludes property acquired by gift bequest devise or inheritance from gross income. Likewise monetary prizes including achievement awards as well as non monetary bonuses like vacation trips awarded for meeting sales goals are taxable compensation not just for income taxes but also for.

Any gift with a value over 50 they said it could be stretched to 75 was taxable even when for a catalogue where the employee chooses their item. If you give out incentive awards as part of a pay package or your employees get awards from a third party you may need to pay paye tax and national insurance contributions nics on them. All cash or gift cards redeemable for cash are taxable to the employee even when given as a holiday gift.

Gift certificates and the newer gift cards are for the most part taxable to employees because they can be converted to cash. Giving gift cards is an easy way to show appreciation to employees which likely improves morale but gift cards can become an administrative burden and anger employees with a tax surprise. If the benefits qualify for exclusion no reporting is necessary.

Can we give gift cards to employees without them being considered taxable income. Taxable income to employees. Is there a minimum amount that would not be considered taxable income.

A fringe benefit can be taxable or nontaxable depending on what it is. The irs classifies a gift card as a type of fringe benefit. There has been some discussion about whether small amount gift cardscertificates.

If the employees are covered for social security and medicare the value of the benefits are also subject to withholding for these. Employers planning on giving gift cards this season should remember that the irs regulations support treating all gift cards and gift certificates provided to an employee as taxable income. There are irs rules on gift cards to employees.

If they are taxable they should be included in wages on form w 2 and subject to income tax withholding. Gift cards given out to workers are considered fringe benefits that is non wage compensation for the performance of services. How are de minimis fringe benefits reported.

Bonuses to employees are considered income and are taxable to the employee.

5 Rules About Income Tax On Gifts Received In India Exemptions

5 Rules About Income Tax On Gifts Received In India Exemptions

What Every Employer Needs To Know About The Tax Reform Law

Are Retirement Gifts Taxable Budgeting Money

Are Retirement Gifts Taxable Budgeting Money

Complete Guide To Gift Cards For Small Businesses Gcg

Complete Guide To Gift Cards For Small Businesses Gcg

5 Taxable Fringe Benefits You Must Report As Income To The Irs

5 Taxable Fringe Benefits You Must Report As Income To The Irs

Income Tax Efiling Received Gifts During The Year Here Is What

Income Tax Efiling Received Gifts During The Year Here Is What

De Minimis Fringe Benefits Internal Revenue Service

Complete Guide To Gift Cards For Small Businesses Gcg

Complete Guide To Gift Cards For Small Businesses Gcg

De Minimis Fringe Benefits Internal Revenue Service

6 Ways To Give Money As A Gift Bankrate Com

6 Ways To Give Money As A Gift Bankrate Com

Nonprofit S Guide To Giving Gifts Ernst Wintter Associates Llp

What Every Employer Needs To Know About The Tax Reform Law

0 Response to "Are Gift Cards Taxable Income To Employees"

Post a Comment