The merchant will charge tax when you buy a taxable item with the gift card. If the benefits qualify for exclusion no reporting is necessary.

Tax Free Vouchers Allgifts Ie

If the employees are covered for social security and medicare the value of the benefits are also subject to withholding for these.

Are gift cards taxed. If you get a gift card as an actual gift as a present from a family member or friend say then its not taxable income. There is such a thing as gift tax but its paid by the person giving a gift not the recipient and its unlikely that a gift card would trigger it. Below are some of the more common questions and answers about gift tax issues.

How are de minimis fringe benefits reported. You dont have to report it or pay taxes on it. When you buy a gift card you dont pay tax on the gift card.

According to the irs gift cards for employees are considered cash equivalent items. Employers planning on giving gift cards this season should remember that the irs regulations support treating all gift cards and gift certificates provided to an employee as taxable income. If they are taxable they should be included in wages on form w 2 and subject to income tax withholding.

Regulations on gift cards. While not federally mandated or explicitly spelled out in every state we outline the best evidence we could find on tax free gift cards and as for your experiences. So are gift cards taxable.

Gift cards should never be taxed at sale but some retailers are breaking state and even their own rules on the matter or finding loopholes. You may also find additional information in publication 559 or some of the other forms and publications offered on our forms pageincluded in this area are the instructions to forms 706 and 709. Like cash gift cards are always included in an employees income.

For example you pay tax on a sweater you buy with a gift card the same as you would when you pay with cash or credit. The taxation of gift cards to employees works the same way as any other. Yesyou will need to record the value and pay the appropriate amount of taxes.

In recent years the sale of gift cards as well as the issuance of gifts cards to customers in exchange for returned merchandise has become a widespread business practice in consumer markets industries especially the retail industry.

Dear Irs I Did Not Report It On My Taxes Because It Was A Gift

Dear Irs I Did Not Report It On My Taxes Because It Was A Gift

100 Tax Free Tip Cards Taxation Is Theft

100 Tax Free Tip Cards Taxation Is Theft

New Jersey Gift Tax All You Need To Know Smartasset

New Jersey Gift Tax All You Need To Know Smartasset

Christmas Gift Vouchers Fical Conditions In Romania Fred Payroll

B H Effectively Cancels Out Internet Sales Tax In Us With Its New

B H Effectively Cancels Out Internet Sales Tax In Us With Its New

When Should Revenue For Gift Cards Be Taxable South African Tax

Employee Incentive Awards Gov Uk

Employee Incentive Awards Gov Uk

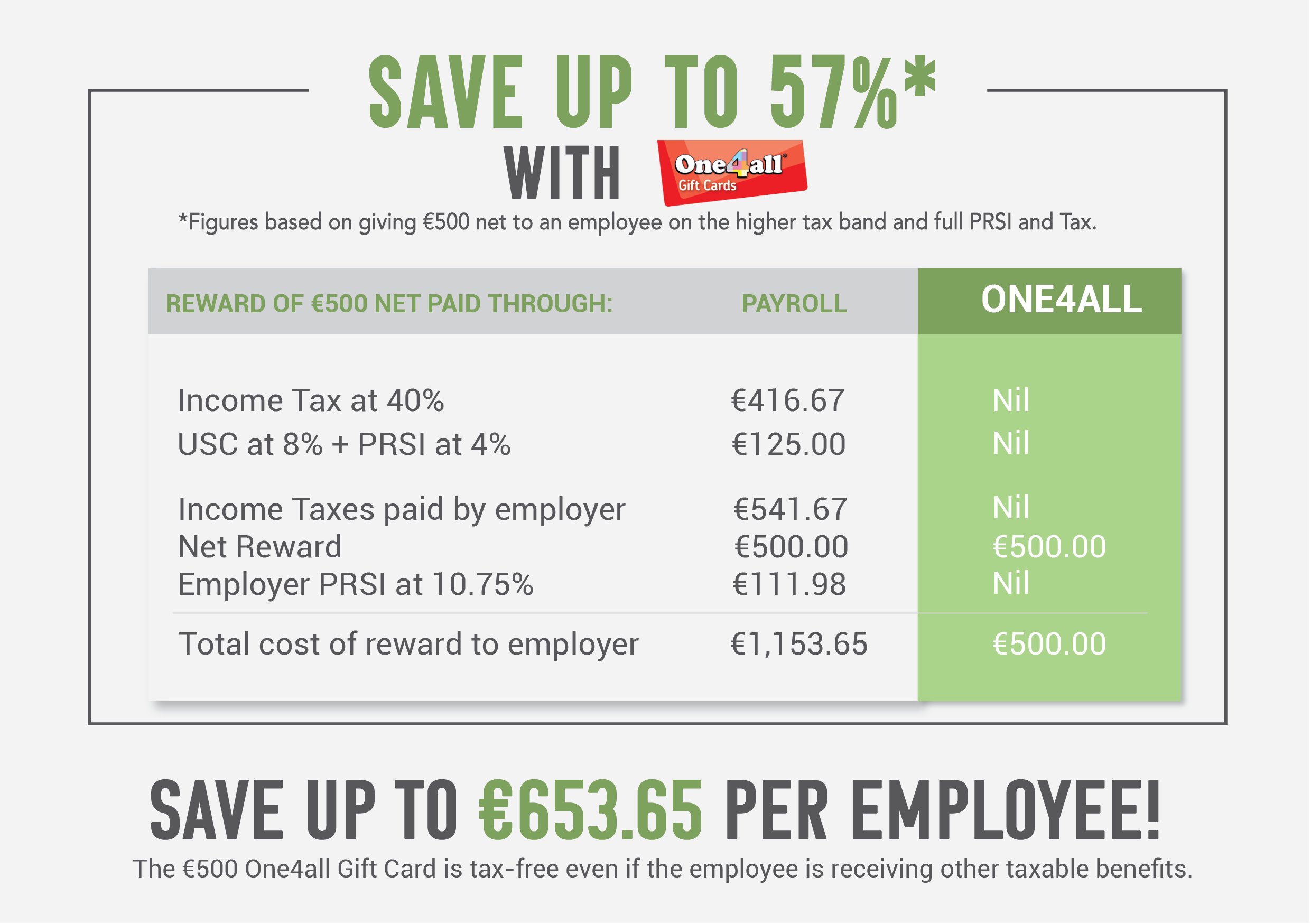

One4all Rewards Benefit In Kind

One4all Rewards Benefit In Kind

Woolies Registers Now Added To Retailers Who Are Displaying

Woolies Registers Now Added To Retailers Who Are Displaying

0 Response to "Ideas For Are Gift Cards Taxed For Everyone"

Post a Comment